April 3, 2017 Today’s Technical Analysis About EURUSD and GBPUSD

EUR/USD-daily-fundamental-forecast-april-03-2017

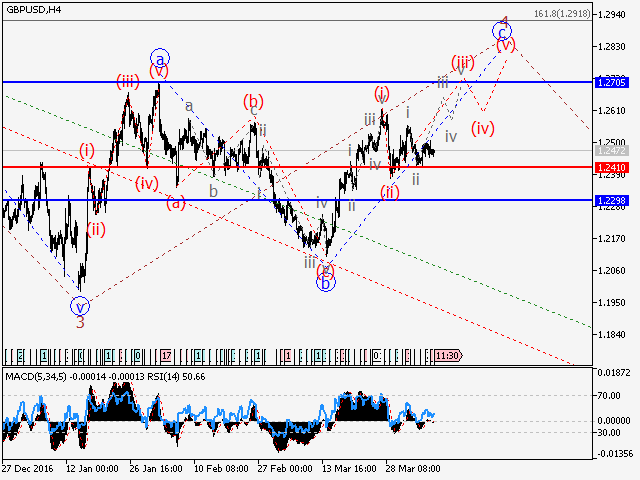

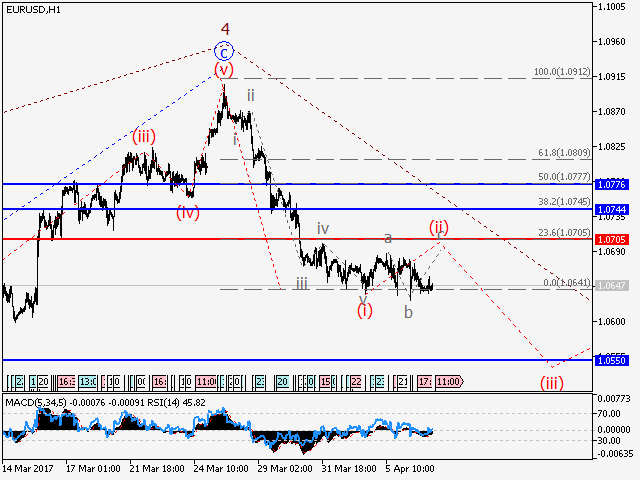

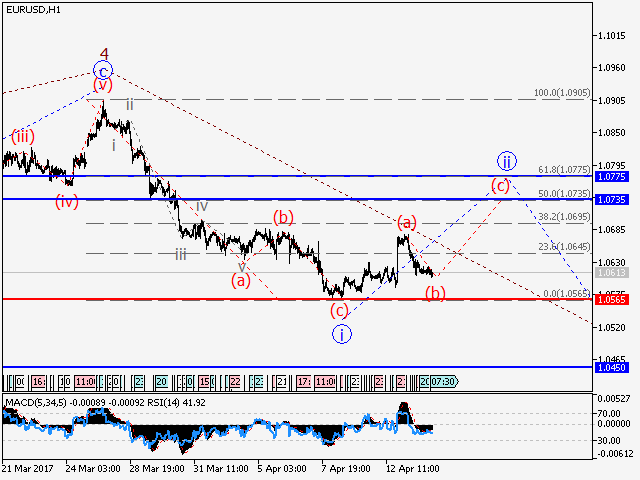

Last Friday, we saw the end of the quarter and the month end as well and the euro was mixed to end the day. This was caused more due to the mixed nature of the dollar rather than any specific event affecting the euro as such. We generally see some month end flows which brings in a bit of volatility in the EURUSD pair and this month end and quarter end flows helped to push the pair further down and we saw the pair moves towards 1.0650 as of last week.

Euro Likely to Consolidate

Today morning, we see a bit of buying in the euro but this is general correction of the move down lower on Friday rather than buying on any specific news or event. Today is the beginning of a new week and a new trading month as well and a lot of news is scheduled to be released during the course of this week. So we can expect some consolidation with a bearish bias during the course of the day as the market and the traders position themselves for the upcoming week.

As is usual with this pair, the moves in this pair is dominated more by the dollar than by the euro in general and so it is all about the dollar strength as of now. The dollar has been buoyed up by the strong data that we saw from the US last week and this is the reason for the fall in the pair over the last week. If the dollar strength continues for today and also for the rest of the week leading upto to the FOMC meeting minutes, we could see the pair sliding further towards the strong support at 1.05 over the next couple of days.

Looking ahead to the rest of the day, we do not have any major news from the Eurozone but we do have the ISM manufacturing PMI data from the US later on in the day. This is not likely to have much impact, especially considering all the major news scheduled for later in the week but we do expect some consolidation with a bearish bias for the rest of the day.

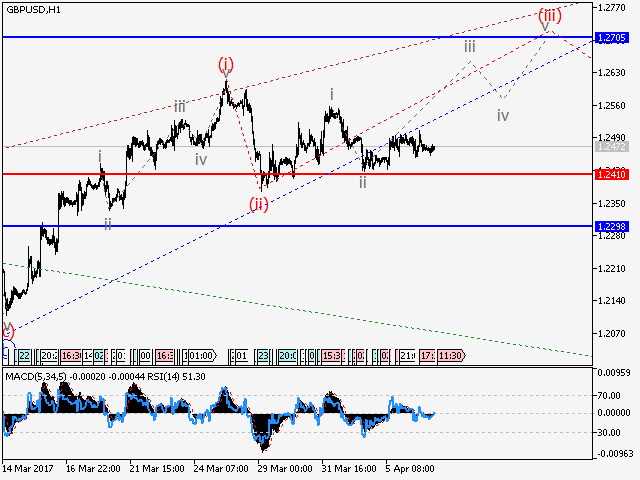

GBP/USD Daily Fundamental Forecast – April 03, 2017

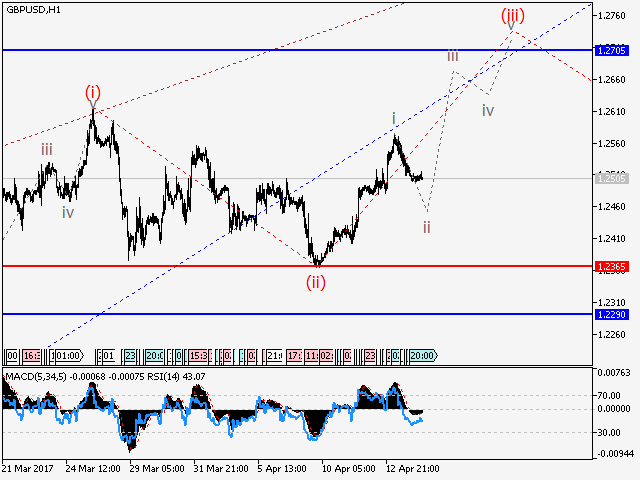

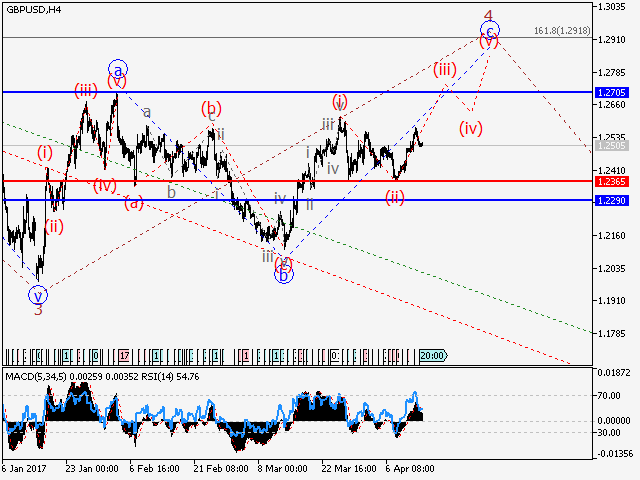

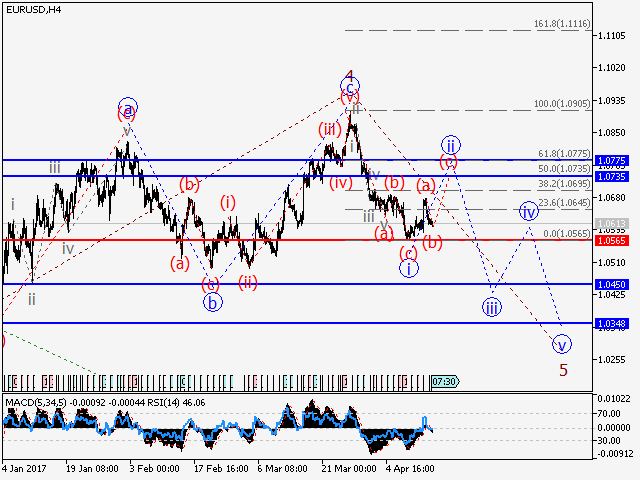

GBPUSD continues to trade strongly amidst some short covering and also due to the month end flows that we saw last week. The pair had risen leading up to the invocation of Article 50 on March 29 and we also noticed an increase in the number of shorts in anticipation of a great fall following the invocation. But what we got was only a fall of 200 pips, more due to an increase in strength of the dollar than due to any major changes in the pound, in the days leading up to the invocation.

GBPUSD Continues to Remain Buoyant

The day of March 29, passed off peacefully without much volatility despite the invocation of Article 50 and this disappointed the bears who had expected a much larger fall. So, in the days after March 29, we saw some short covering as the disappointed bears exited their positions and this led to the rise of the GBPUSD pair from the lows of its range around 1.24 to above 1.25 and it trades comfortably close to 1.2550 as of this writing.

It looks quite bullish at the moment but we believe that the pair is due for some correction of the bounce that it has had so far. This is the first week of the month and with a variety of news loaded for the rest of the week, we would expect some consolidation today. Also, the region around 1.26 had shown a lot of selling the previous time when the price was here and so we expect the same if and when the price visits there again.

Looking ahead to the rest of the day, we have the Manufacturing PMI data from the UK and the PMI data from the US as well and these data are likely to bring in a bit of volatility. We expect any upmove to be capped by the 1.26 region and we expect some consolidation with a bearish bias for the rest of the day.

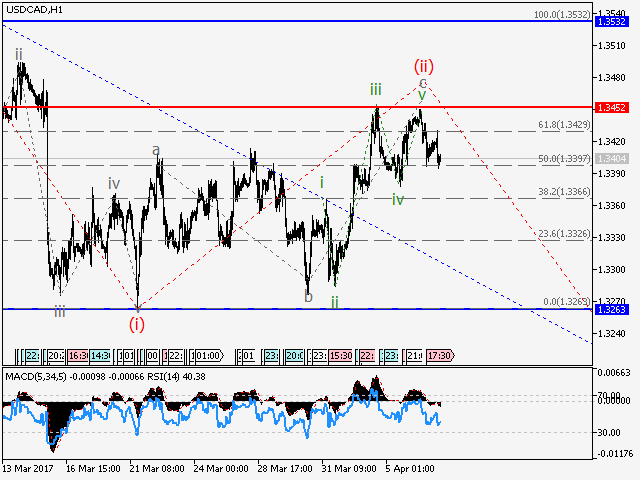

DCAD

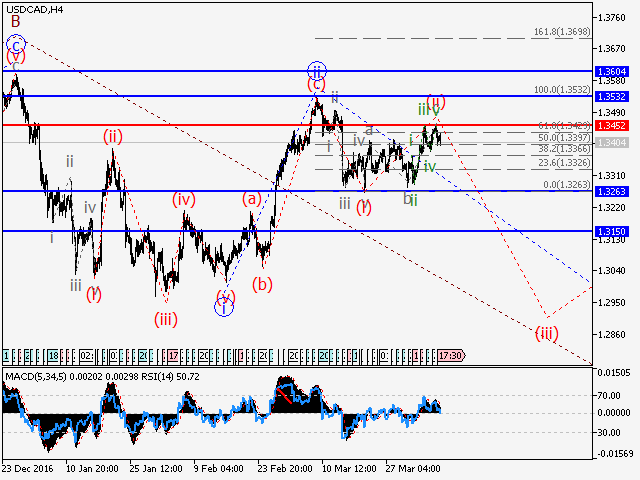

DCAD