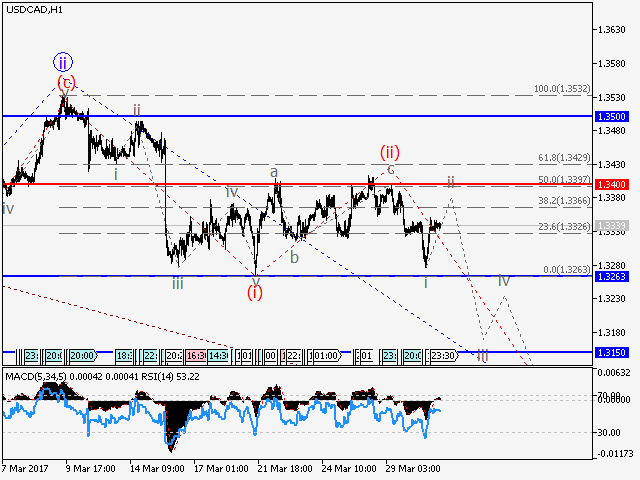

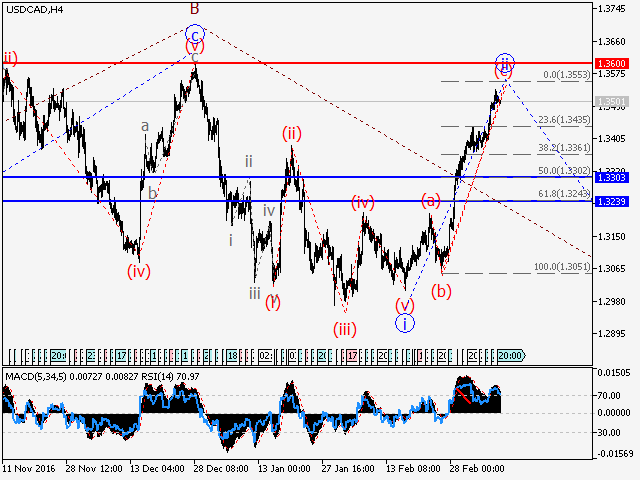

USDCAD Wave analysis and forecast for 31.03 – 07.04

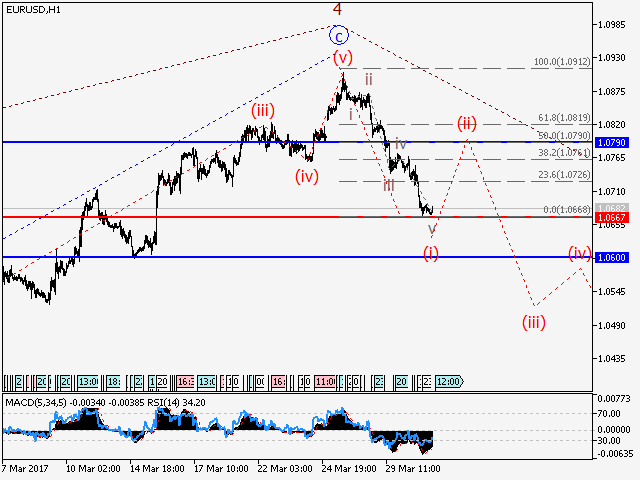

Wave analysis and forecast for 31.03 – 07.04: The pair is likely to decline.

Estimated pivot point is at the level of 1.3400.

Analysis: Presumably, the formation of the third wave of the senior level iii of C continues, within which upward correction as the wave (ii) has completed. . Locally, it is likely that the one-two impetus of the junior level i of (iii) has been formed. If this assumption is correct, the pair can continue to decline to 1.3150. Critical level for this scenario is 1.3400.

Alternative scenario: Breakout and consolidation of the price above the level of 1.3400 will trigger further rise in the pair up to 1.3500.

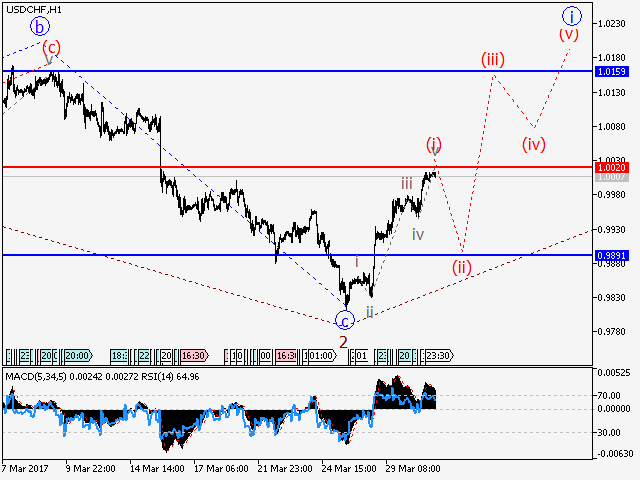

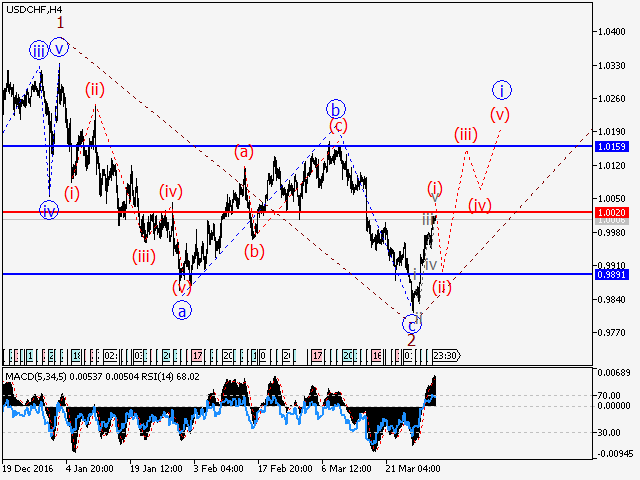

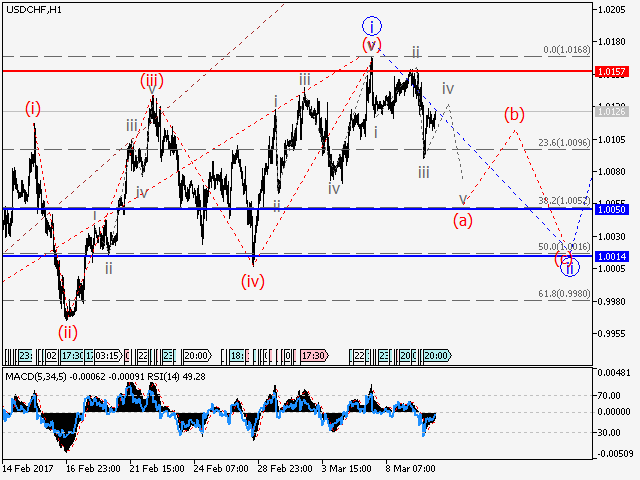

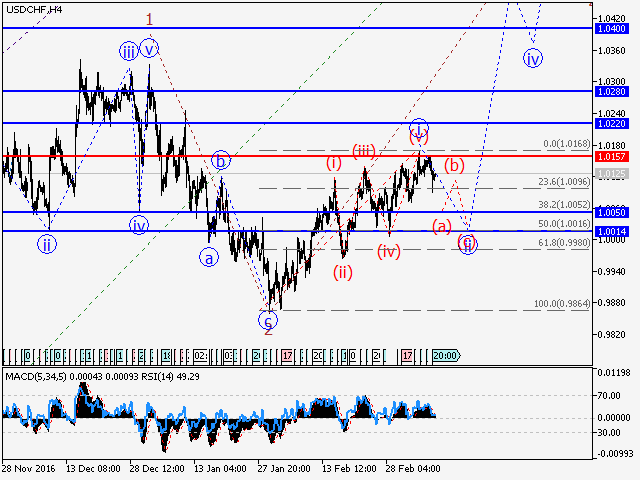

Our opinion: Sell the pair from correction below the level of 1.0157 with the target of 1.0050 – 1.0014.

Our opinion: Sell the pair from correction below the level of 1.0157 with the target of 1.0050 – 1.0014.