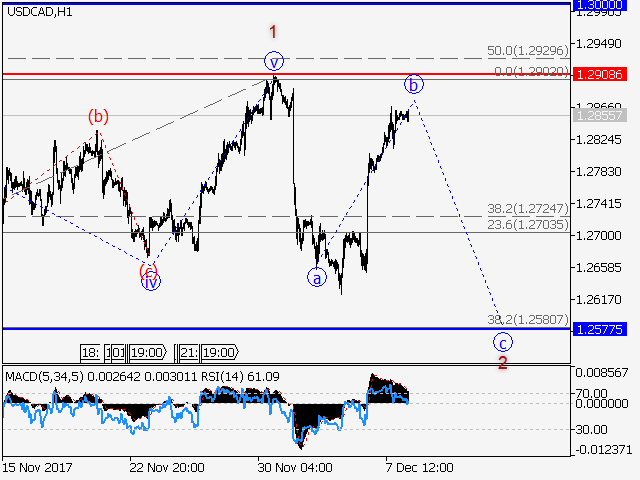

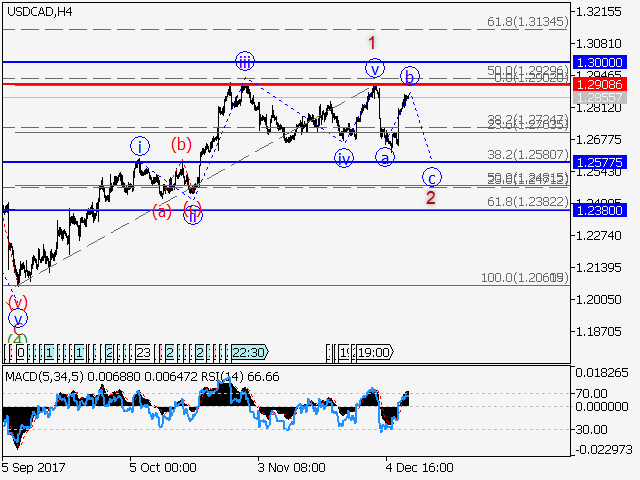

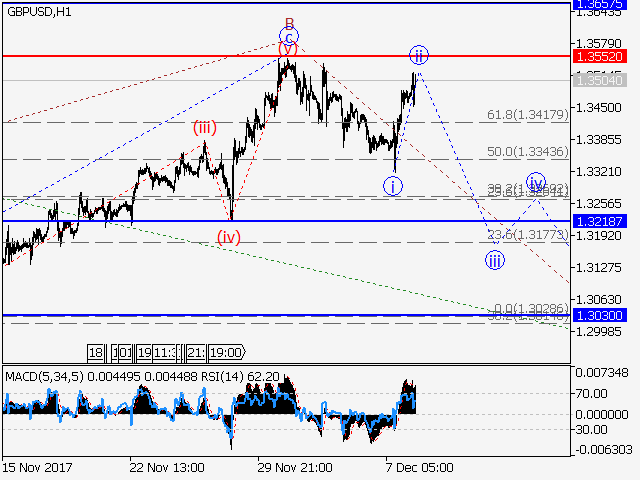

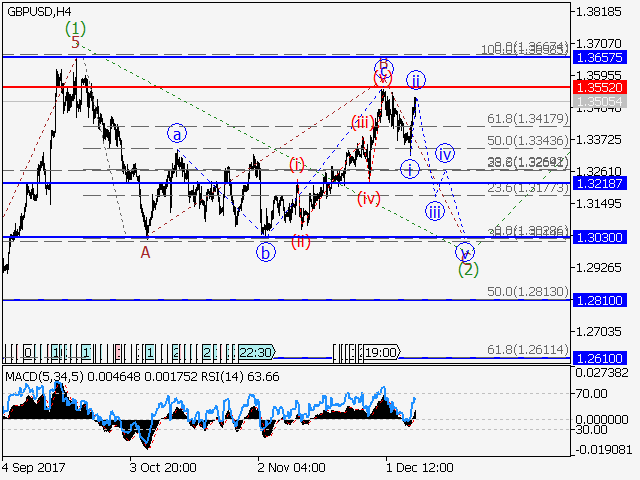

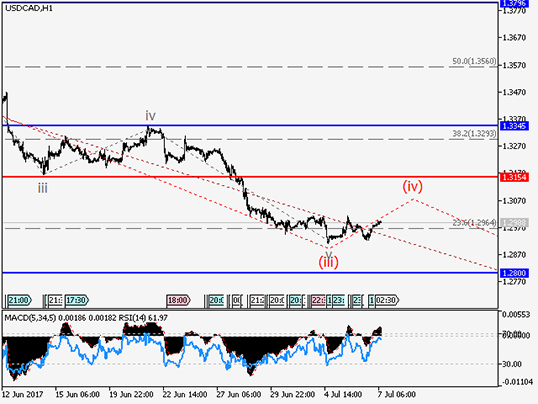

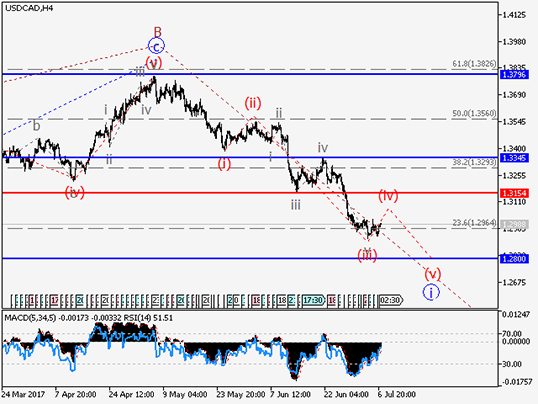

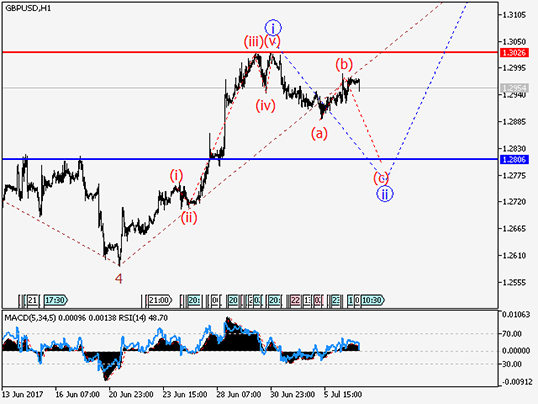

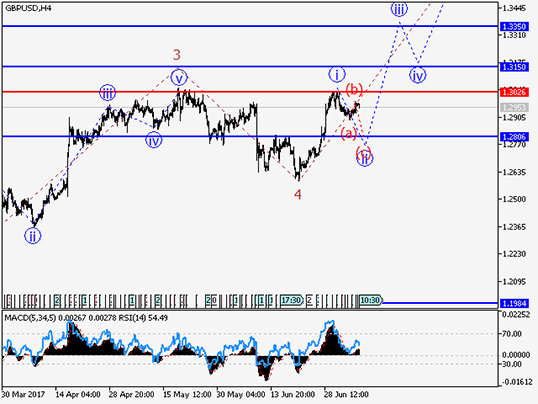

Estimated pivot point is at a level of 1.2908.

Main scenario: short positions will be relevant below the level of 1.2908 with a target of 1.2577.

Alternative scenario: breakout and consolidation above the level of 1.2908 will allow the pair to continue rising to a level of 1.3000.

Analysis: supposedly, a descending correction continues to develop within the 4-hour time frame in the form of the wave 2 of (5). Apparently, an upward correction of junior level in the form of the fourth wave iv of C has finished forming locally. If the assumption is correct, the pair will continue falling to the levels of 1.2577. The level 1.2908 is critical in this scenario.