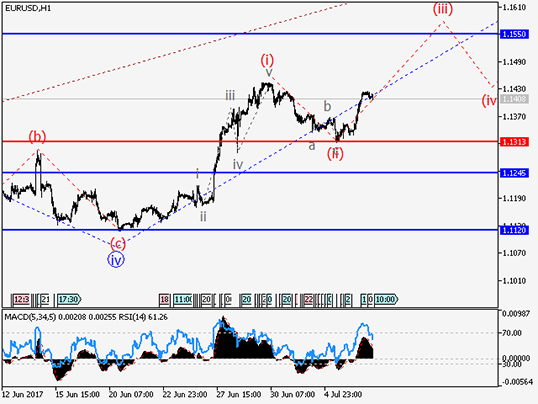

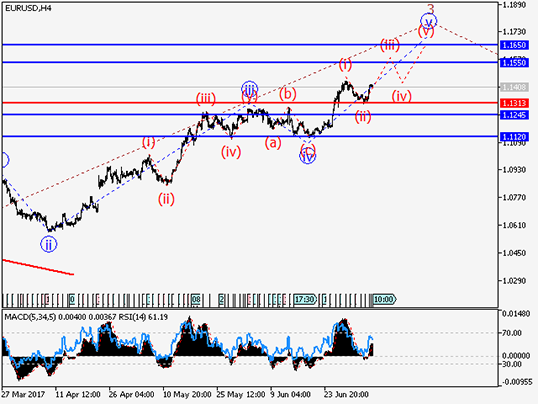

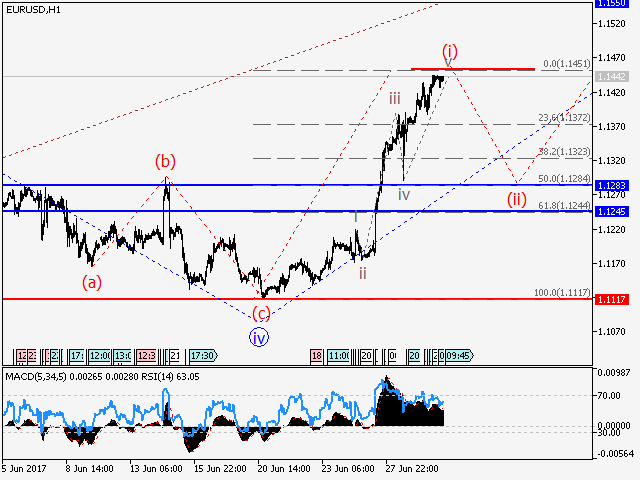

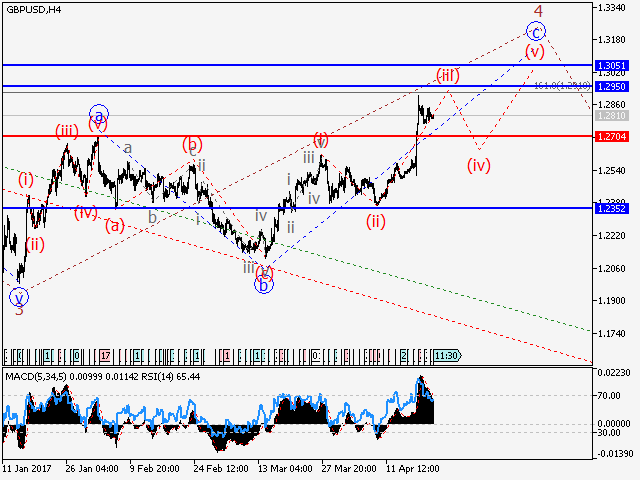

EURUSD Wave analysis and forecast for 30.06 – 07.07

Wave analysis and forecast for 30.06 – 07.07: Uptrend continues.

Estimated pivot point is at the level of 1.1313.

Analysis: Presumably, on the four-hour timeframe the formation of the uptrend continues as third wave of the senior level 3. At the moment, it seems that the fifth wave v of 3 is being formed, within which correction (ii) has completed and the third wave of the junior level (iii) is being developed. If this assumption is correct, the pair may continue to rise up to the levels of 1.1550 – 1.1650. Critical level for this scenario is 1.1313.

Alternative scenario: Breakdown and consolidation of the price below the level of 1.1313 may trigger further decline in the pair to 1.1245.