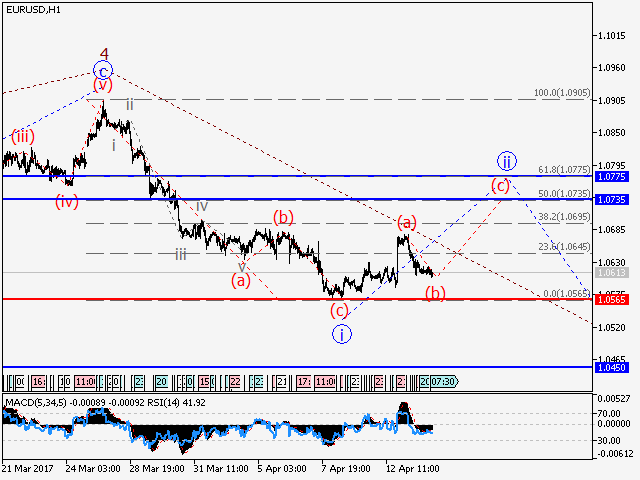

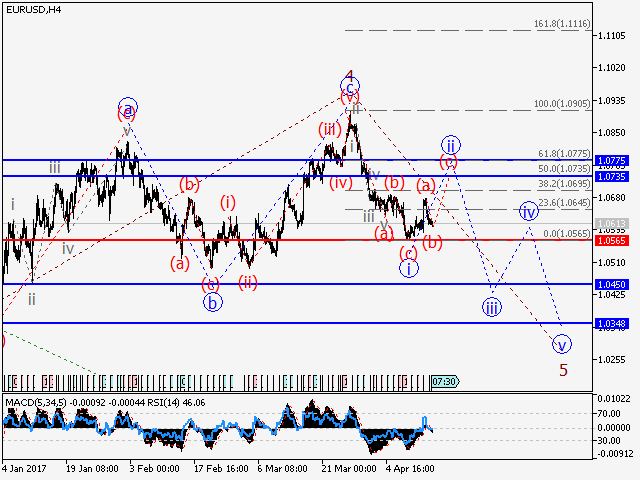

EURUSD Wave analysis and forecast for 21.04 – 28.04

Wave analysis and forecast for 21.04 – 28.04: The pair is expected to decline.

Estimated pivot point is at the level of 1.0776.

Analysis: Supposedly, the fifth wave 5 of senior level continues to form. Apparently, the first wave i of 5 has formed as a zigzag-like pattern, which allows us to suppose that a diagonal triangle may form in the fifth wave. Apparently, the ascending correction ii of 5 is completed in a zigzag-like form at a correction level of 62%. If the presumption is correct, the pair will logically resume dropping to the levels 1.0600 – 1.0450. The level 1.0776 is critical in this scenario.

Alternative scenario: Breakout and consolidation above the level of 1.0776 will allow the pair to continue rising to a level of 1.0904.

US

US

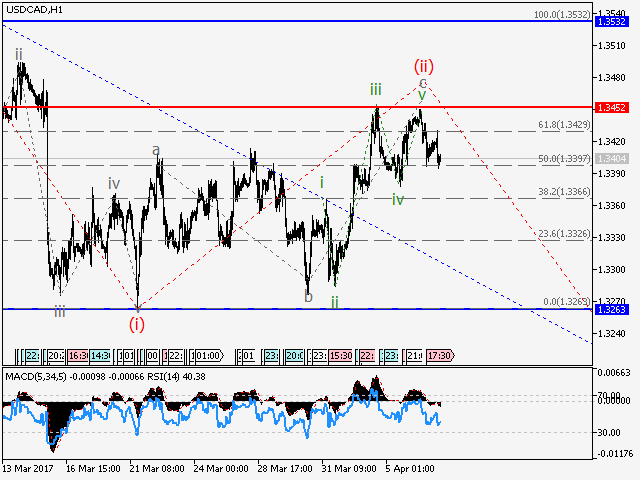

DCAD

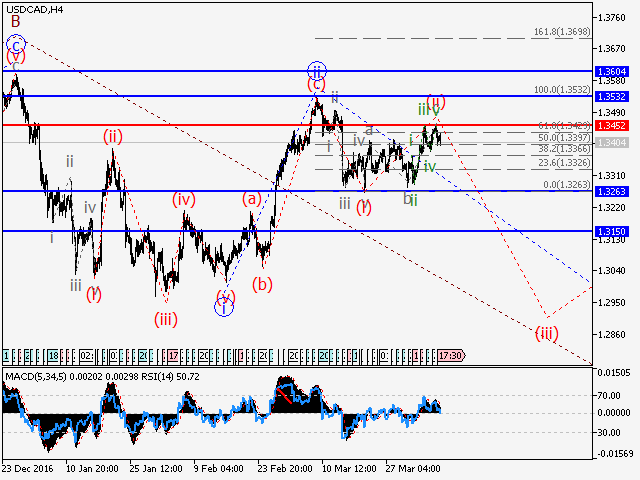

DCAD