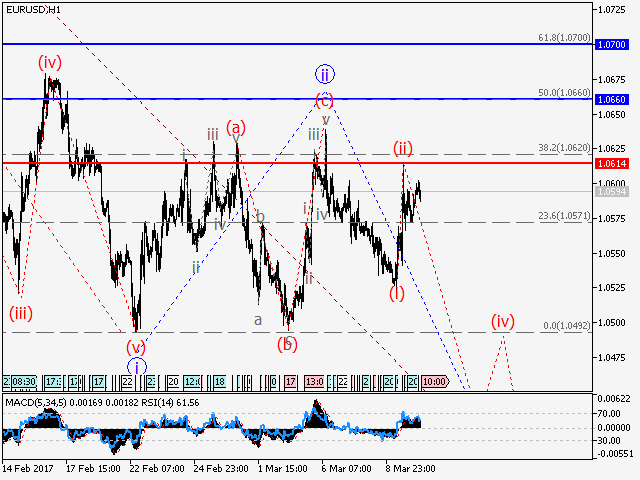

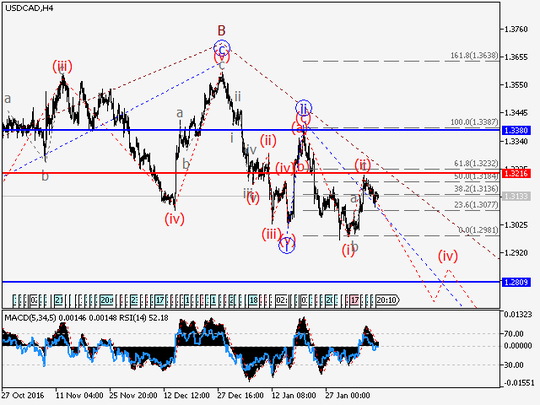

Wave analysis and forecast for 10.03 – 17.03: The pair is undergoing correction. The decline is likely to continue.

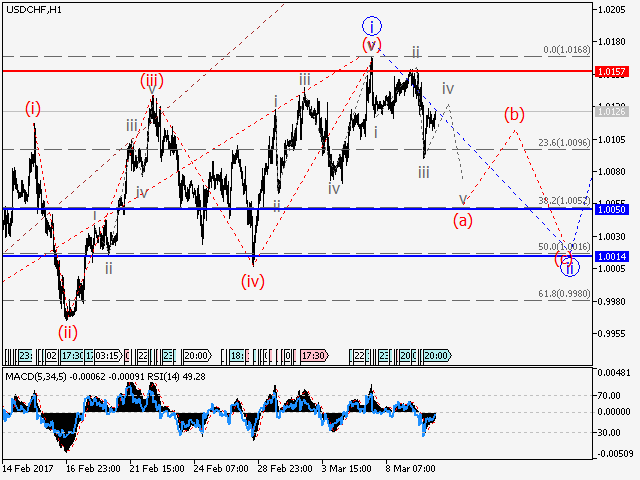

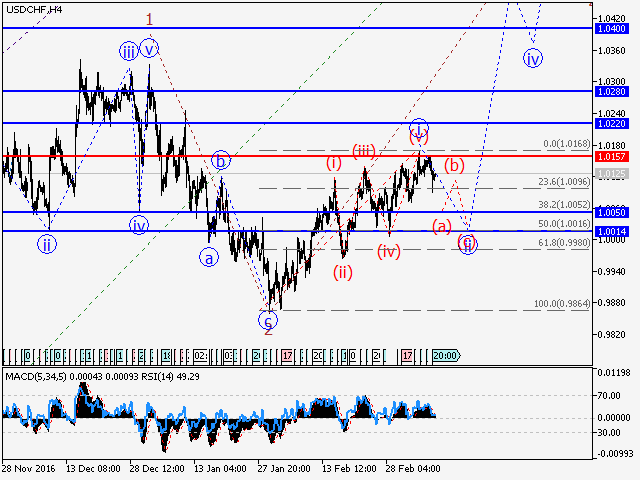

Estimated pivot point is at the level of 1.0157.

Analysis: Presumably, the formation of the first wave I within the third wave of the senior level continues. Locally, it is likely that the downward correction ii of 3 is being developed within which a wave (a) is being formed. If this assumption is correct, the decline in the pair can continue to 1.0050 – 1.0014. Critical level for this scenario is 1.0157.

Alternative scenario: Breakout and consolidation of the price above the level of 1.0157 will trigger the rise in the pair to 1.0220 – 1.0280.

Our opinion: Sell the pair from correction below the level of 1.0157 with the target of 1.0050 – 1.0014.

Our opinion: Sell the pair from correction below the level of 1.0157 with the target of 1.0050 – 1.0014.