Account Management Trading Monthly Results For The Month Of May 2017 By ForexGuru.PK And DigiTech.Com.PK

Account Management Trading Monthly Results For The Month Of May 2017 By ForexGuru.PK And DigiTech.Com.PK

Account Management Trading Monthly Results For The Month Of May 2017 By ForexGuru.PK And DigiTech.Com.PK

DigiTech.Com.Pk Is Starting New Batch Of Forex Account Management In Pakistan. Hopefully Going To Accept New Clients In End Of June 2017 Or In The Beginning Of July 2017.

Trading Results Of May 2017 Are Attached – Statement Of 10 Pages

Total Profit In Pips = 2470 PIPS In May

Total Profit Percentage On $500 = 49.40%

Max Draw Down = 15%

Average Monthly Return We Expect = 10-50%

For Details Call 0300-6561240

or Visit www.digitech.com.pk

Forex Account Management In Pakistan Monthly Trading Results For April 2017 By ForexGuru.Pk And DigiTech.Com.Pk

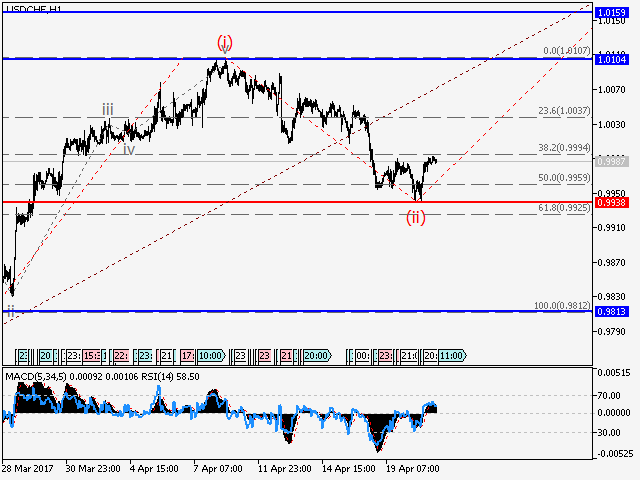

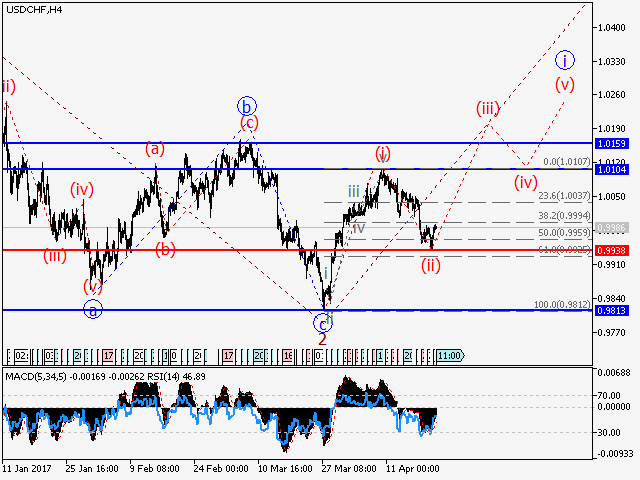

Wave analysis and forecast for 21.04 – 28.04: The pair is expected to grow.

Estimated pivot point is at the level of 0.9938.

Analysis: Supposedly, the third wave 3 of senior level continues to form. Apparently, a counter-trend impetus has been formed as the wave (i) and the descending correction (ii) has reached Fibonacci 50% and finished developing locally. If the presumption is correct, the pair will logically resume rising to a level of 1.0104 – 1.0160 within the third wave (iii). The level 0.9938 is critical in this scenario.

Alternative scenario: Breakout and consolidation below the level of 0.9938 will allow the pair to continue declining to a level of 0.9813.

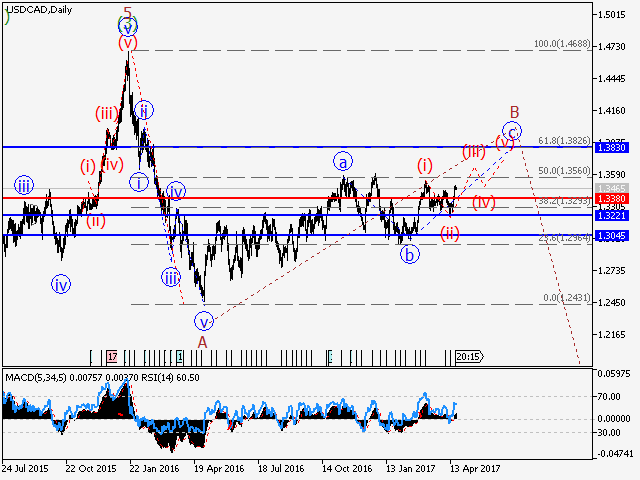

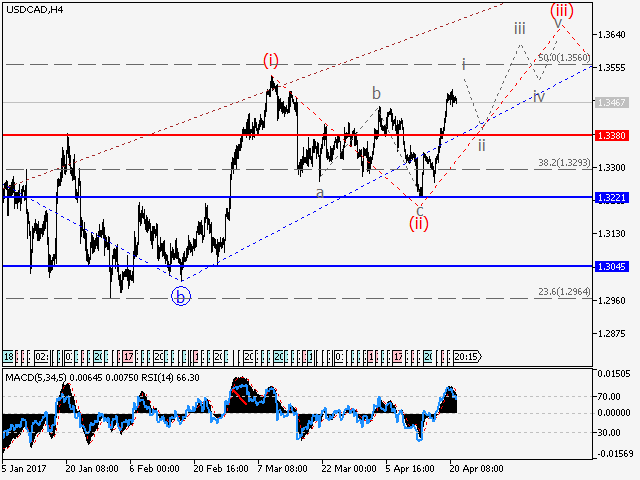

Wave analysis and forecast for 21.04 – 28.04: The pair resumes growth.

Estimated pivot point is at the level of 1.3380.

Analysis: Apparently, a long-term ascending correction within the wave B continues to form. Presumably, the wave c of B is developing locally, with the third wave of junior level (iii) forming within. If the presumption is correct, the pair will continue to rise to the levels 1.3560 – 1.38. The level of 1.3380 may be critical in this scenario as the breakout will enable the pair to continue declining to the level of 1.3220.

Alternative scenario: Breakout and consolidation below the level of 1.3380 will allow the pair to continue declining to the level of 1.3220.

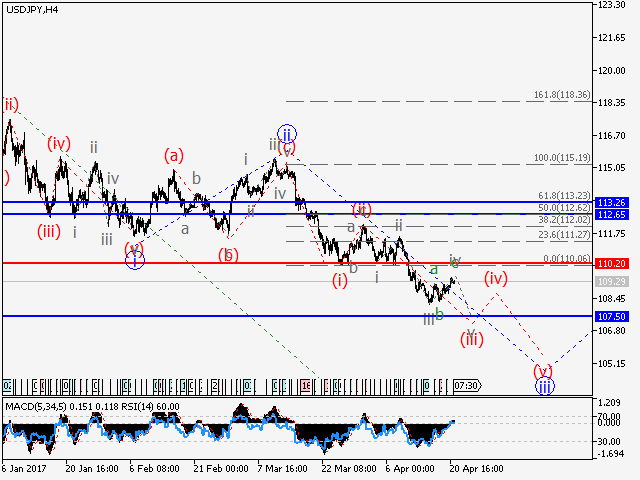

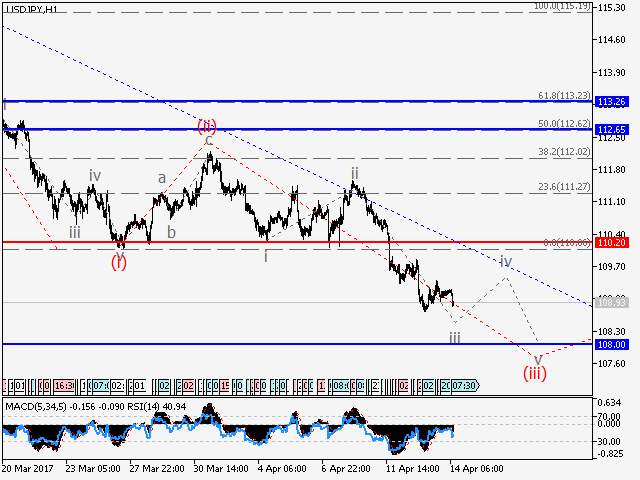

Wave analysis and forecast for 21.04 – 28.04: Downtrend continues.

Estimated pivot point is at the level of 110.20.

Analysis: Supposedly, a downtrend continues forming within the third wave iii of senior level. Apparently, the third wave (iii) of junior level is developing locally, with an ascending correction iv of (iii) nearing completion inside. If the presumption is correct, the pair will logically continue to drop to the level of 107.50. The level 110.20 is critical in this scenario.

Alternative scenario: Breakout and consolidation above the level of 110.20 will allow the pair to continue the rise up to the levels of 112.65 – 113.26.

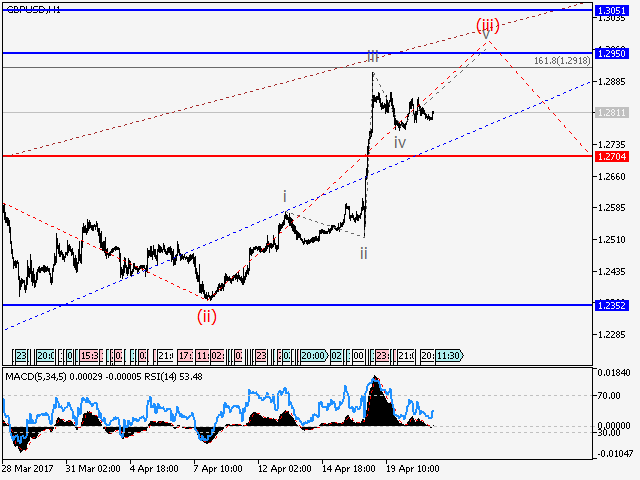

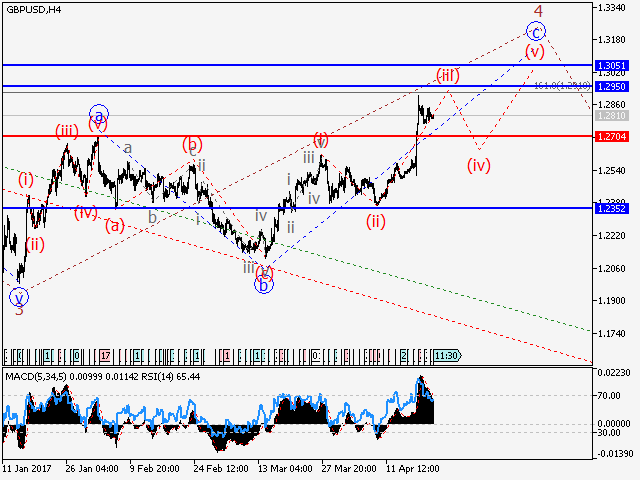

Wave analysis and forecast for 21.04 – 28.04: Uptrend continues.

Estimated pivot point is at the level of 1.2704.

Analysis: Presumably, an ascending correction of senior level continues to form as the fourth wave 4, with the wave c of 4 developing within. Apparently, the third wave (iii) of c continue to form locally, with a bullish impetus developing inside. If the presumption is correct, the pair will continue to rise to the levels 1.2950 – 1.3050. The level 1.2704 is critical in this scenario.

Alternative scenario: Breakout and consolidation below the level of 1.2704 will allow the pair to continue declining to a level of 1.2350.

Wave analysis and forecast for 21.04 – 28.04: The pair is expected to decline.

Estimated pivot point is at the level of 1.0776.

Analysis: Supposedly, the fifth wave 5 of senior level continues to form. Apparently, the first wave i of 5 has formed as a zigzag-like pattern, which allows us to suppose that a diagonal triangle may form in the fifth wave. Apparently, the ascending correction ii of 5 is completed in a zigzag-like form at a correction level of 62%. If the presumption is correct, the pair will logically resume dropping to the levels 1.0600 – 1.0450. The level 1.0776 is critical in this scenario.

Alternative scenario: Breakout and consolidation above the level of 1.0776 will allow the pair to continue rising to a level of 1.0904.

[wpmlfield name=”fullname”]

[newsletters_posts numberposts=”5″ showdate=”Y” eftype=”excerpt” orderby=”post_date” order=”DESC” category=”2″]

Wave analysis and forecast for 14.04 – 21.04: Downtrend continues.

Estimated pivot point is at the level of 110.20.

Analysis: Presumably, the formation of the third wave iii of the senior level continues. Locally, it is likely that the upward correction (ii) has completed and the third wave (iii) of the junior level is being formed. If this assumption is correct, the pair may continue to decline to 108.00. Critical level for this scenario is 110.20.

Alternative scenario: BBreakout and consolidation of the price above the level of 110.20 will trigger further rise in the pair up to 112.65 – 113.26.

US

US

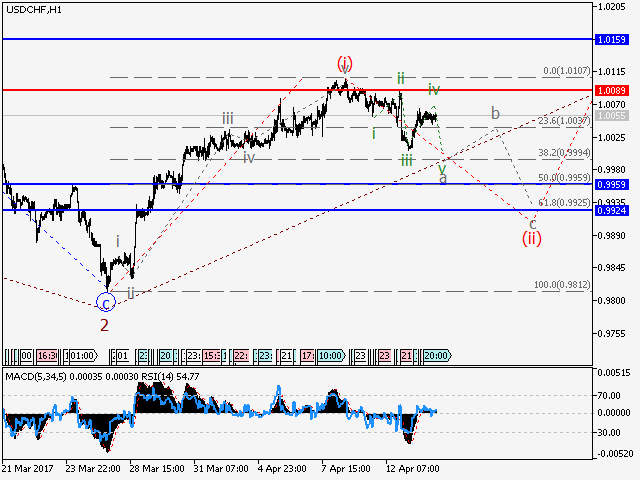

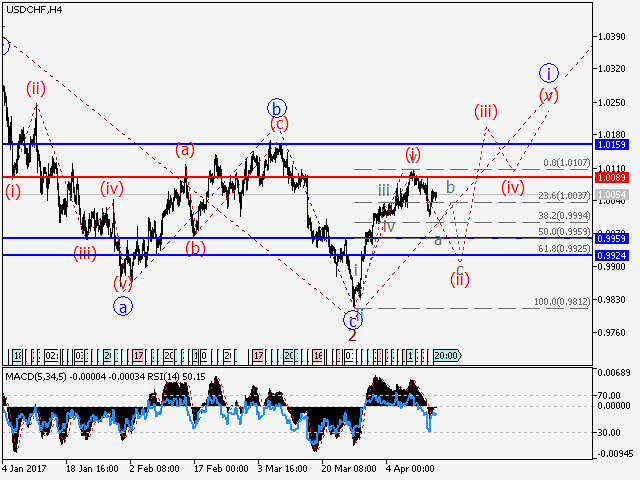

Wave analysis and forecast for 14.04 – 21.04: The decline in the pair is likely to continue.

Estimated pivot point is at the level of 1.0089.

Analysis: Presumably, the formation of the third wave 3 of the senior level continues. Locally it seems that the one-two impetus as the wave (i) has been formed and the downward correction (ii) is being developed. If this assumption is correct, the pair may decline to the level of 0.9960 – 0.9925 in the second wave (ii). Critical level for this scenario is 1.0089.

Alternative scenario: Breakout and consolidation of the price above the level of 1.0089 will trigger rise in the pair up to 1.0160.