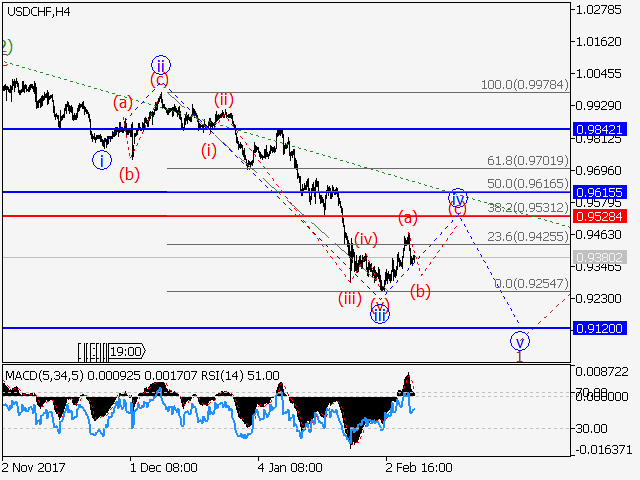

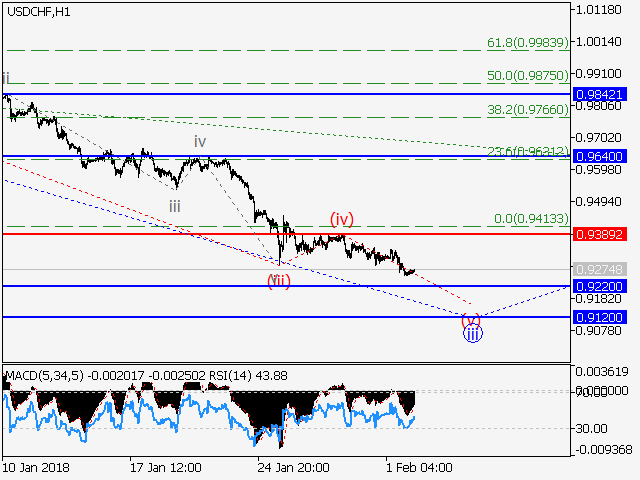

USD/CHF Wave analysis and forecast for 09.02 – 16.02

Estimated pivot point is at a level of 0.9528.

Main scenario: short positions will be relevant with a target of 0.9120 once correction has finished below the level of 0.9528.

Alternative scenario:Breakout and consolidation above the level of 0.9528 will allow the pair to continue rising to a level of 0.9615 – 0.9700.

Analysis: Supposedly, a downward trend within the first wave of senior level 1 of (3) continues to develop within the 4-hour time frame. Apparently, a local correction is now forming as the fourth wave iv of 1. If this assumption is correct, the pair will continue declining to a level of 1.0950 once the correction is over. The level 0.9528 may be critical in this scenario.