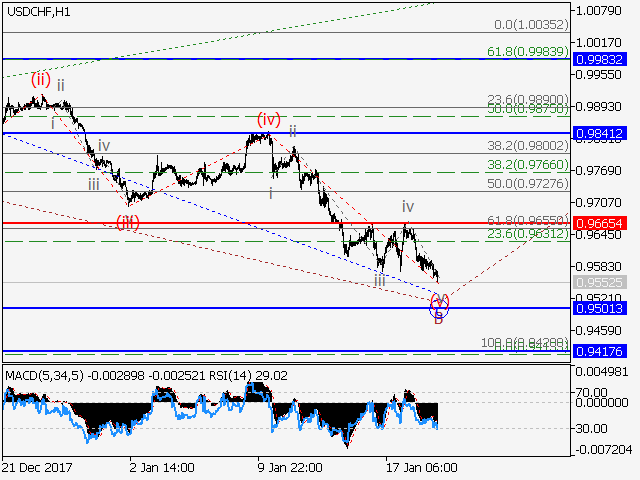

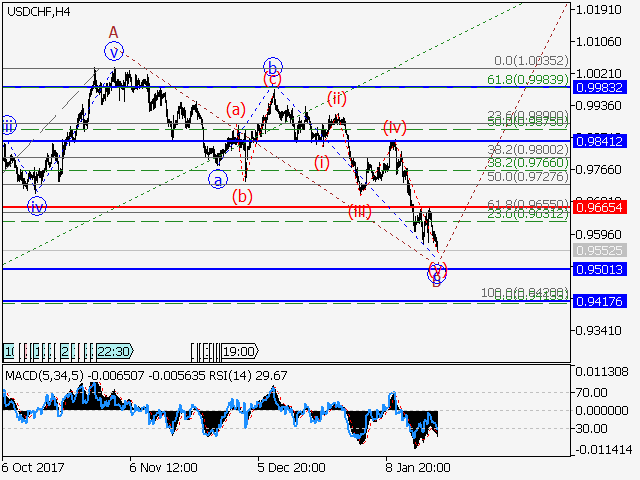

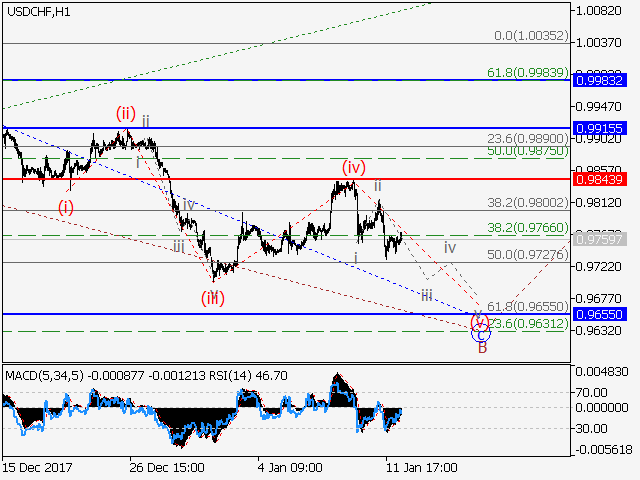

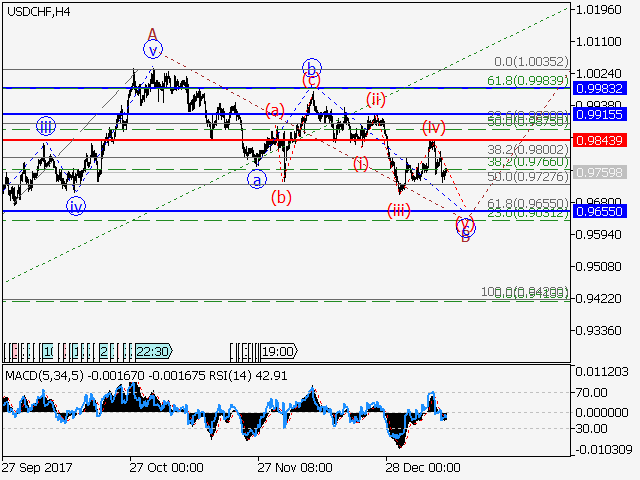

USD/CHF Wave analysis and forecast for 26.01 – 02.02

Estimated pivot point is at a level of 0.9514.

Main scenario: short positions will be relevant from corrections below the level of 0.9514 with a target of 0.9220 and lower.

Alternative scenario:breakout and consolidation above the level of 0.9514 will allow the pair to continue rising to a level of 0.9845.

Analysis: Supposedly, a downward trend within the third wave of senior level (3) continues to develop within the 4-hour time frame. Apparently, the first wave 1 of (3) is forming now, with the wave iii of 1 of junior level developing within. If this assumption is correct, the pair will go on dropping to the level of 0.9220 and lower. The level 0.9514 is critical in this scenario.