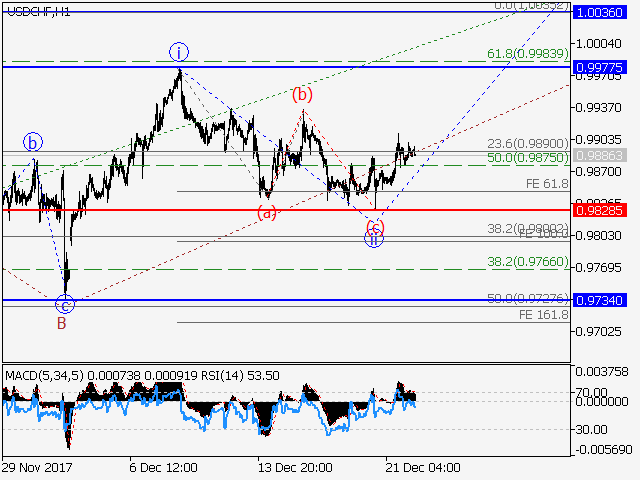

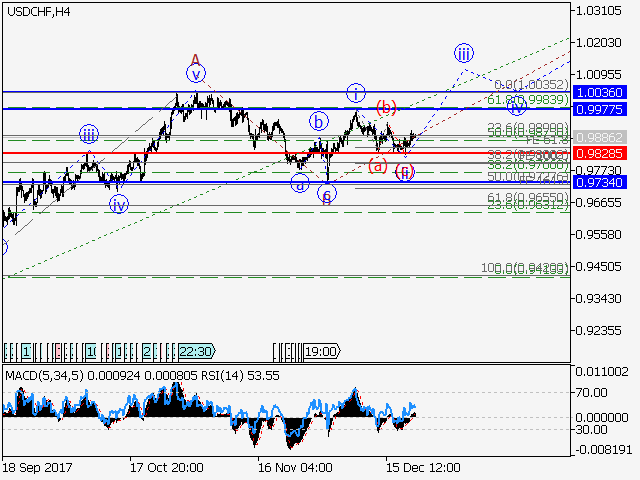

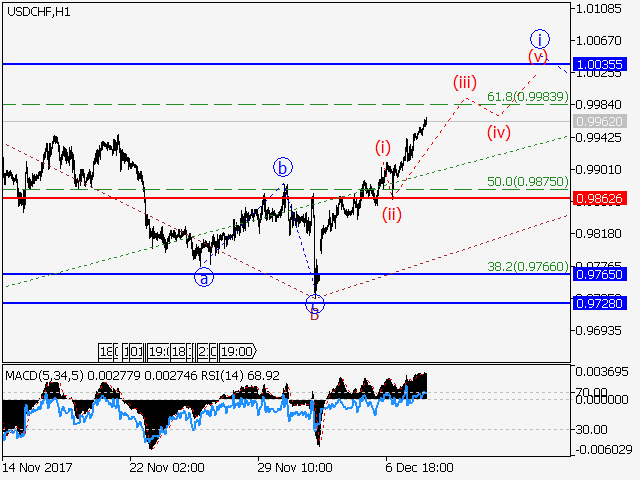

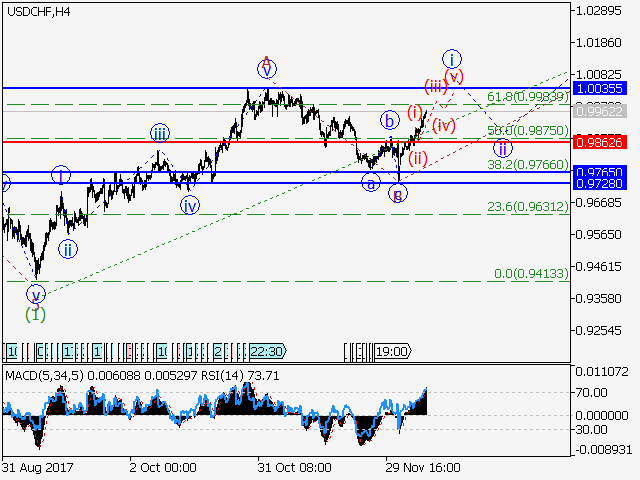

Estimated pivot point is at a level of 0.9828.

Main scenario: long positions will be relevant from corrections above the level of 0.9828 with a target of 0.9977 – 1.0036.

Alternative scenario: breakout and consolidation below the level of 0.0.9828 will allow the pair to continue declining to a level of 0.9734.

Analysis: supposedly, an ascending correction in the form of the wave (2) of senior level continues developing within the 4-hour time frame. Apparently, the first wave С of (2) is forming locally, with the downward correction of junior level i of C completed in the form of the wave ii of C inside. If the presumption is correct, the pair may continue rising to the levels of 0.9977 – 1.0036. The level 0.9837 is critical in this scenario.