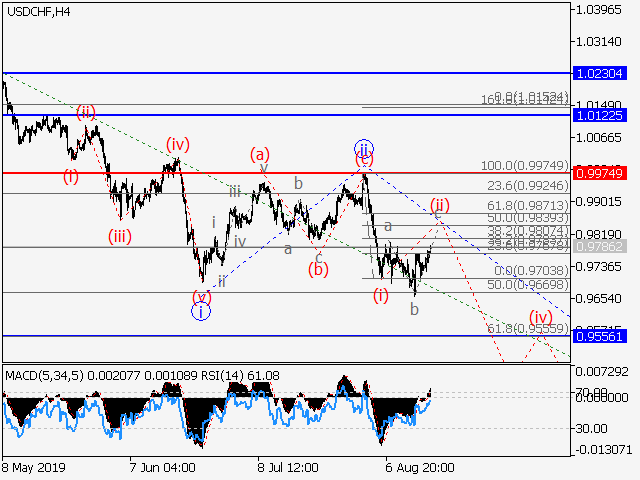

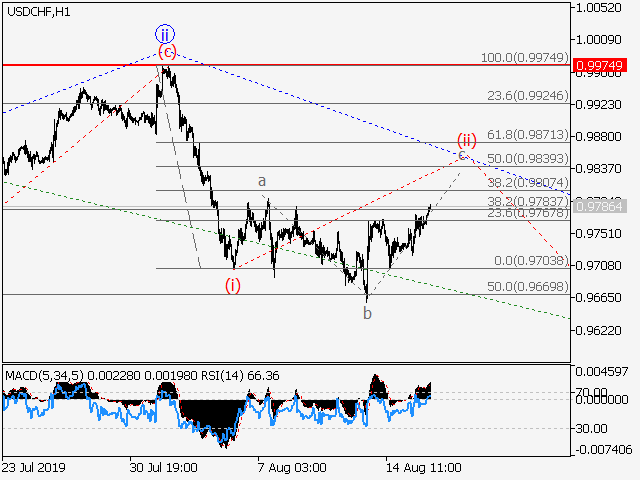

USD/CHF: Elliott wave analysis and forecast for 16/08/2019 – 23/08/2019

The USD/CHF pair is under correction, still likely to fall. Estimated pivot point is at a level of 0.9974.

Main scenario: short positions will be relevant from corrections below the level of 0.9974 with a target of 0.9556 – 0.9188 once the correction is completed.

Alternative scenario: breakdown and consolidation above the level of 0.9974 will allow the pair to continue the rise up to the levels of 1.0122 – 1.0230.

Analysis: Supposedly, an ascending correction of senior level in the form of the wave (2) finished developing on the D1 time frame and the wave (3) started forming. The third wave of junior level is forming inside the wave 1 of (3) on the H4 time frame. Apparently, the local correction (ii) of iii is forming on the H1 time frame. If the presumption is correct, the pair will resume falling to the level of 0.9556 inside the wave (iii) of iii once the correction is over. The level of 0.9974 is critical in this scenario. Its breakout will allow the pair to continue rising to the levels 1.0122 – 1.0230.